Accounting

Cash vs. Accrual Accounting: What's Right for Your Store?

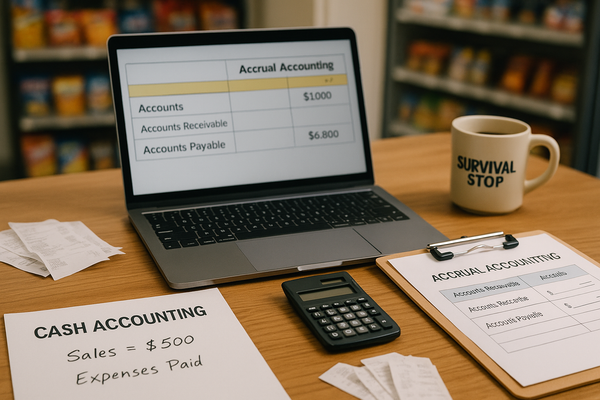

Choosing between cash and accrual accounting impacts taxes, cash flow management, and business growth. Recent tax law changes raised the threshold to $25 million, allowing more C-store owners to choose cash accounting even with substantial inventory operations.